the blog

How to Budget When Your Income Changes Every Month

What if I told you that your unpredictable income isn't a budgeting nightmare – it's actually your secret weapon for building wealth faster than your salaried friends?

Most self-employed professionals think irregular income makes budgeting impossible. They bounce between feast and famine months, stuffing money under the metaphorical mattress during good times and scrambling during lean periods. But what nobody tells you is that once you master the art of variable income budgeting, you'll have financial flexibility that traditional employees can only dream of.

The problem isn't your income fluctuations. The problem is trying to force traditional budgeting methods onto a completely different financial reality.

LLC vs Sole Proprietorship: Which One Actually Saves You Money?

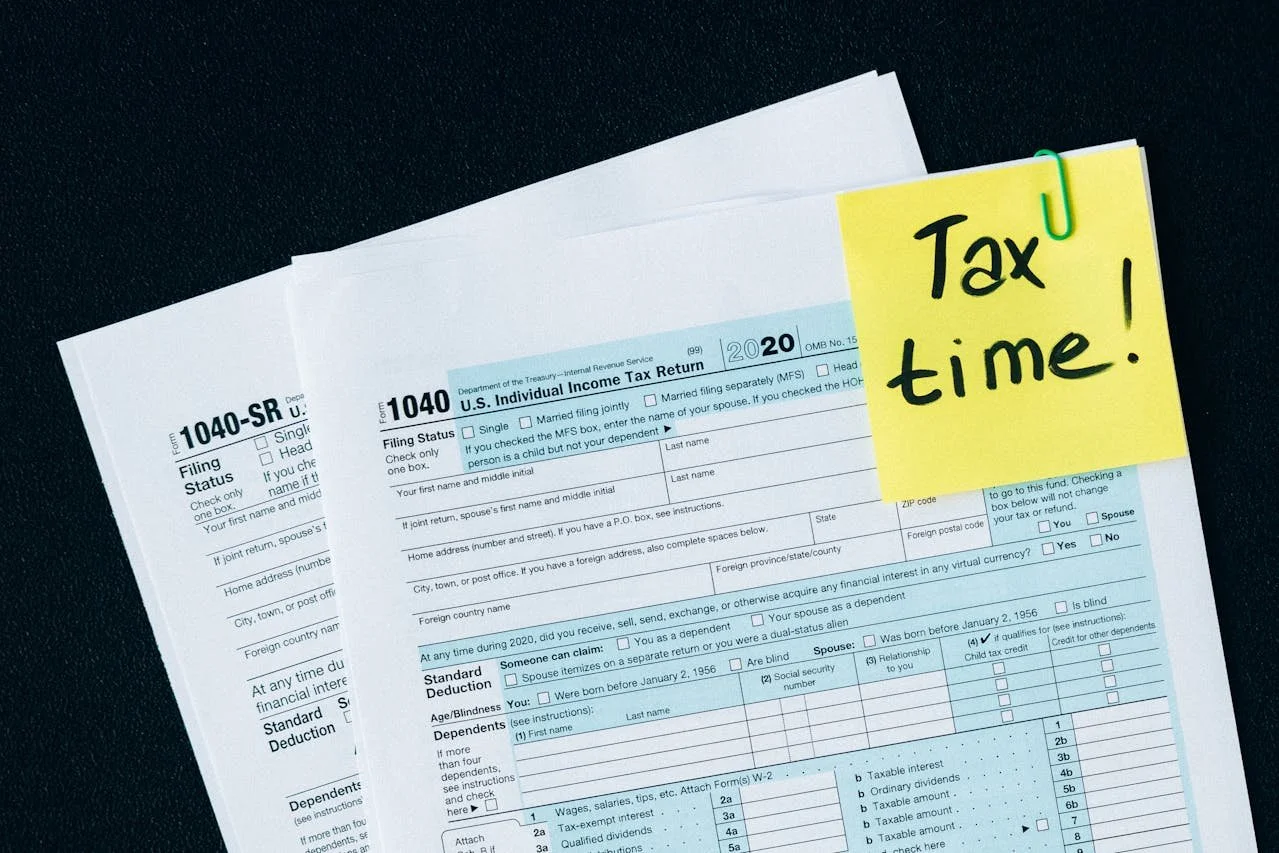

You know that pit in your stomach when you suddenly remember another quarterly tax deadline is coming up? I get it. So many people I talk to treat quarterly payments like this scary mystery they can never quite figure out.

But it really doesn't have to be this stressful dance every three months. When you actually understand what's going on and get a basic system in place, it just becomes another thing you do to keep your business running. No more panic mode, no more wild guessing, no more staying up at night wondering if you've saved enough.

I'm going to show you exactly how to handle this stuff without all the stress. Consider this your no-nonsense guide to actually feeling confident about your quarterly taxes.

How to Pay Quarterly Taxes Without the Panic (Step-by-Step)

You know that pit in your stomach when you suddenly remember another quarterly tax deadline is coming up? I get it. So many people I talk to treat quarterly payments like this scary mystery they can never quite figure out.

But it really doesn't have to be this stressful dance every three months. When you actually understand what's going on and get a basic system in place, it just becomes another thing you do to keep your business running. No more panic mode, no more wild guessing, no more staying up at night wondering if you've saved enough.

I'm going to show you exactly how to handle this stuff without all the stress. Consider this your no-nonsense guide to actually feeling confident about your quarterly taxes.